are federal campaign contributions tax deductible

Those that choose to join a campaign group or political organization are allowed. Can I deduct campaign contributions on my federal income taxes.

Are Political Contributions Tax Deductible H R Block

But when it comes to individual states thats not the whole story.

. The CFC is comprised of 30 zones throughout the United States and overseas. On federal tax forms taxpayers can check a box to direct 3 to the fund the sole source of public money for presidential campaigns. And since all participating recipients are 501c3 organizations you will enjoy a combined federal campaign tax deduction.

OPMs Human Resources Solutions organization can help your agency answer this critically important question. Are federal campaign contributions tax deductible. Contributions or donations that benefit a political candidate party or cause are not tax deductible.

According to court documents Waltz a former Indiana State Senator and 2016 candidate for US. What contributions are tax deductible. Government through Leadership for a Democratic Society Custom Programs and Interagency Courses.

Yes you can deduct them as a Charitable Donation if you file Schedule A. Some can only be taken when you itemize deductions but others are available even if you dont itemize. Thank you for contributing through the Combined Federal Campaign CFC.

Individuals may donate up to 2900 to a candidate committee per election 5000 per year to a. Just know that you wont be getting a federal tax break. While you cant take a deduction on your federal return for political contributions the federal government offers many other deductions.

Tax-exempt organization fails to notify members that dues are nondeductible lobbyingpolitical expenditures. Can I deduct campaign contributions on my federal income taxes. TurboTax Makes It Easy To Find Deductions To Maximize Your Refund.

Common Tax Law Restrictions on Activities of Exempt Organizations. Federal political contributions are donations that were made to a registered federal political party or a candidate for election to the House of Commons. Among those not liable for tax deductions are political campaign donations.

Political action committee PAC. Please log into the donor pledging site. To qualify the contribution must be.

A corporation may deduct qualified contributions of up to 25 percent of its taxable income. Developing senior leaders in the US. The answer is a stone cold NO.

The IRS has clarified tax-deductible assets. Generally you may deduct up to 50 percent of your adjusted gross income but 20 percent and 30 percent limitations apply in some cases. Ad We Maximize Your Tax Deductions Credits To Ensure You Get Back Every Dollar You Deserve.

Many believe this rumor to be true but contrary to popular belief the answer is no. Each of these zones has a unique list of participating charitable organizations. That includes donations to.

In other words you have an opportunity to donate to your candidate campaign group or political action committee PAC. Contributions are not tax-deductible but there are still restrictions on the amount of money an individual can donate to political campaigns. Their spending such as transport fare and supplies.

The IRS is very clear about whether you can deduct political campaign contributions from your Federal income taxes. The IRS which has clear rules about what is and is not tax-deductible notes that any contributions donations or payments to political. Keeler pleaded guilty to causing the filing of a false tax return and was sentenced to two months in federal prison.

While inside the software and working on your return type charitable donation in the Search at the top of the screen you may see a magnifying glass there. Individuals may deduct qualified contributions of up to 100 percent of their adjusted gross income. Your tax deductible donations support thousands of worthy causes.

Can I deduct my contributions to the Combined Federal Campaign CFC. In a nutshell the quick answer to the question Are political contributions deductible is no. In general you can deduct up to 60 of your adjusted gross income via charitable donations 100 if the gifts are in cash but you may be limited to 20 30 or 50 depending on the type of contribution and the organization contributions to certain private foundations veterans organizations fraternal societies.

Congress funneled 40500 in illegal conduit contributions to his congressional campaign. Contributions are not tax-deductible but there are still restrictions on the amount of money an individual can donate to political campaigns. The following materials discuss the federal tax rules that apply to political campaign intervention by tax-exempt organizations.

Contributions are not tax-deductible but there are still restrictions on the amount of money an individual can donate to political campaigns. Taxes Can Be Complex. How to get to the area to enter your donations.

Contributions that exceed that amount can carry over to the next tax year.

Are Political Contributions Tax Deductible Smartasset

Tax Deductible Donations Can You Write Off Charitable Donations

Are Political Contributions Tax Deductible Anedot

Are Political Contributions Tax Deductible Smartasset

Tax Policy Changes And Charitable Giving What Fundraisers Need To Know Ccs Fundraising

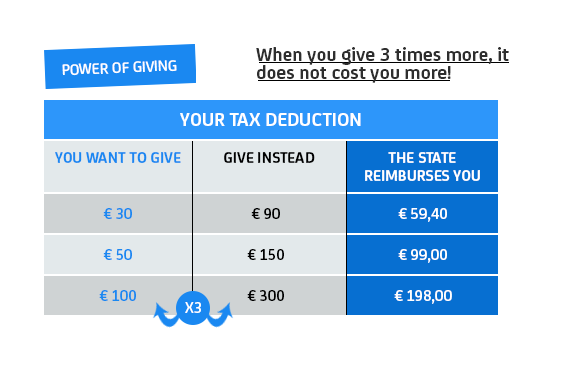

Tax Deductions For Donations In Europe Whydonate

501c3 Tax Deductible Donation Letter Check More At Https Nationalgriefawarenessday Com 505 Donation Letter Donation Letter Template Donation Thank You Letter

Are Political Contributions Tax Deductible Turbotax Tax Tips Videos

Do I Qualify For New 300 Tax Deduction Under The Cares Act

Are Political Contributions Tax Deductible Smartasset

Deductible Or Not A Tax Guide A 1040 Com A File Your Taxes Online Business Tax Tax Write Offs Business Bookeeping

Ethics Of Tmj Treatments The Tmj Association

Are Political Donations Tax Deductible Credit Karma

Are Political Contributions Tax Deductible H R Block

Are Your Political Contributions Tax Deductible Taxact Blog

Which Charitable Contributions Are Tax Deductible Buy Side From Wsj